42 difference between yield to maturity and coupon rate

humantruth.org /de/difference-between-yield-to-maturity-and-vs-coupon-rate What is the difference between coupon rate and yield to ... Bonds are issued for a fixed term and pay a stated rate (coupon) for a stated period of time. For example $1,000 bond principal at 5% for 10 years. If you bought it at par for $1,000 and held it for maturity, you'd get $50 a year and your $1,000 principal back at maturity. Your coupon rate and yield to maturity would be the same 5%.

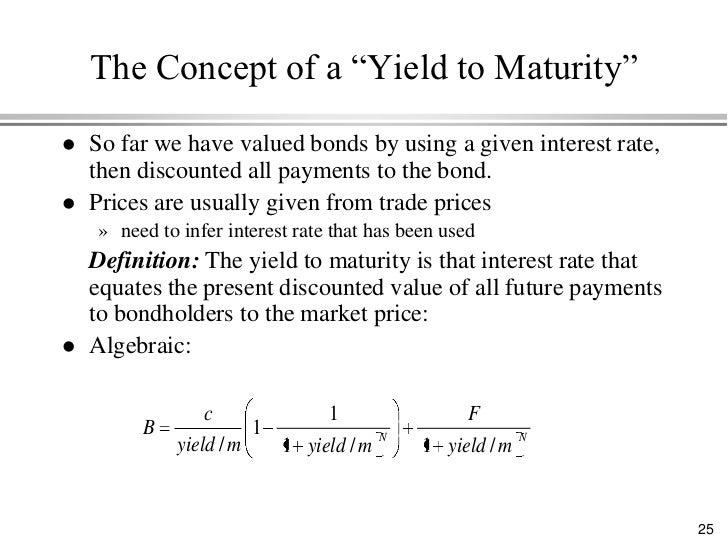

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. The coupon...

Difference between yield to maturity and coupon rate

Difference Between Current Yield and Coupon Rate (With ... The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same. Coupon Rate Definition Sep 05, 2021 · The yield to maturity is when a bond is purchased on the secondary market, and it's the difference in the bond's interest payments, which may be higher or lower than the bond's coupon rate when it ... Coupon vs Yield | Top 8 Useful Differences (with Infographics) While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date. The coupon amount is the amount that is paid out semi-annually or annually till the maturity date on the face value of the bond.

Difference between yield to maturity and coupon rate. Yield to Maturity vs Coupon Rate: What's the Difference ... While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. Difference Between Yield and Coupon | Compare the ... A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%. Summary: What is the effective annual yield formula? Effective yield is calculated by dividing the coupon payments by the current market value of the bond. return based on its annual coupon payments and current price, as opposed to the face value. Though similar, current yield doesn't assume coupon reinvestment, as effective yield does. How are bond yields different from coupon rate? | The ... The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the ...

Coupon Rate Calculator | Bond Coupon As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond investments if you hold them ... Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion Current Yield: Bond Formula and Calculator [Excel Template] If a bond is trading at par, the current yield is equal to the stated coupon rate – thus, the current yield on the par bond is 6%. But for the discount bond, the current yield (6.32%) is higher than the coupon rate, whereas the opposite is true for the premium bond (5.71%). Difference between YTM and Coupon Rates - Difference Betweenz Coupon rates also play a role in determining a bond's yield (the return that an investor receives on their investment). Difference between YTM and Coupon Rates. YTM is the acronym for "yield to maturity", and it measures the rate of return an investor would earn if they held a bond until it reached maturity.

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Difference Between Yield to Maturity and Coupon Rate ... The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1. Coupon Rate vs Yield Rate for Bonds - Wall Street Oasis If by Yield you mean Yield to Maturity, then it is the discount rate on the bond's cash flows. Bond Price = NPV of the CF's of the Bond = (Face Value)(Coupon Rate)/(1 + YTM) + (Face Value)(Coupon Rate)/(1 + YTM)^2 + ... + [(Face Value)*(Coupon Rate) + Face Value]/(1 + YTM)^n, where n is maturity for the bond. Since interest rates (discount rates) for each period aren't necessarily the same, if ... Yield To Maturity Vs. Coupon Rate: What's The Difference? The yield to maturity is the estimated annual charge of return for a bond assuming that the investor holds the asset till its maturity date and reinvests the funds on the similar charge. The coupon charge is the annual earnings an investor can count on to obtain whereas holding a selected bond.

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Solved 1. What is the difference between coupon rates and ... What is the difference between coupon rates and yield to maturity, and how do these differences impact bond prices? 2. Why are long-term bond prices more volatile than short-term bond prices? 3. How might the yield to maturity change for an organization in the event of a credit upgrade or downgrade by rating agencies? 4. Fixed income securities are

Difference between Coupon Rate And Yield To Maturity ... Hence in simpler words, the coupon can be referred to as the fixed amount of interest a bond will pay per annum, where the yield to maturity is the anticipated return when the bond is held till its date of maturity.

Difference Between YTM and Coupon rates Difference Between YTM and Coupon rates YTM vs coupon rates When buying a new bond and planning to keep it until maturity, the shifting of prices, interest rates, and yields, will generally not affect you, except if the bond is called. However, if an existing bond is bought or sold, the price that the investors are willing to pay for it

Bootstrapping | How to Construct a Zero Coupon Yield Curve in ... Note that the difference between the first and second example is that we have considered the zero-coupon rates to be linear in example 2 whereas they are compounding in example 1. Example #3. Although this is not a direct example of a bootstrapping yield curve, sometimes one needs to find the rate between two maturities.

Difference Between Variable and Parameter | Compare the ... May 31, 2012 · Difference Between Yield to Maturity and Coupon Rate Difference Between Pentacle and Pentagram What is the Difference Between Ecotropic Amphotropic and Pantropic Virus.

Coupon Rate - Meaning, Calculation and Importance Know the Difference's between Coupon Rate & YTM. The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond.

Post a Comment for "42 difference between yield to maturity and coupon rate"