39 us treasury coupon rate

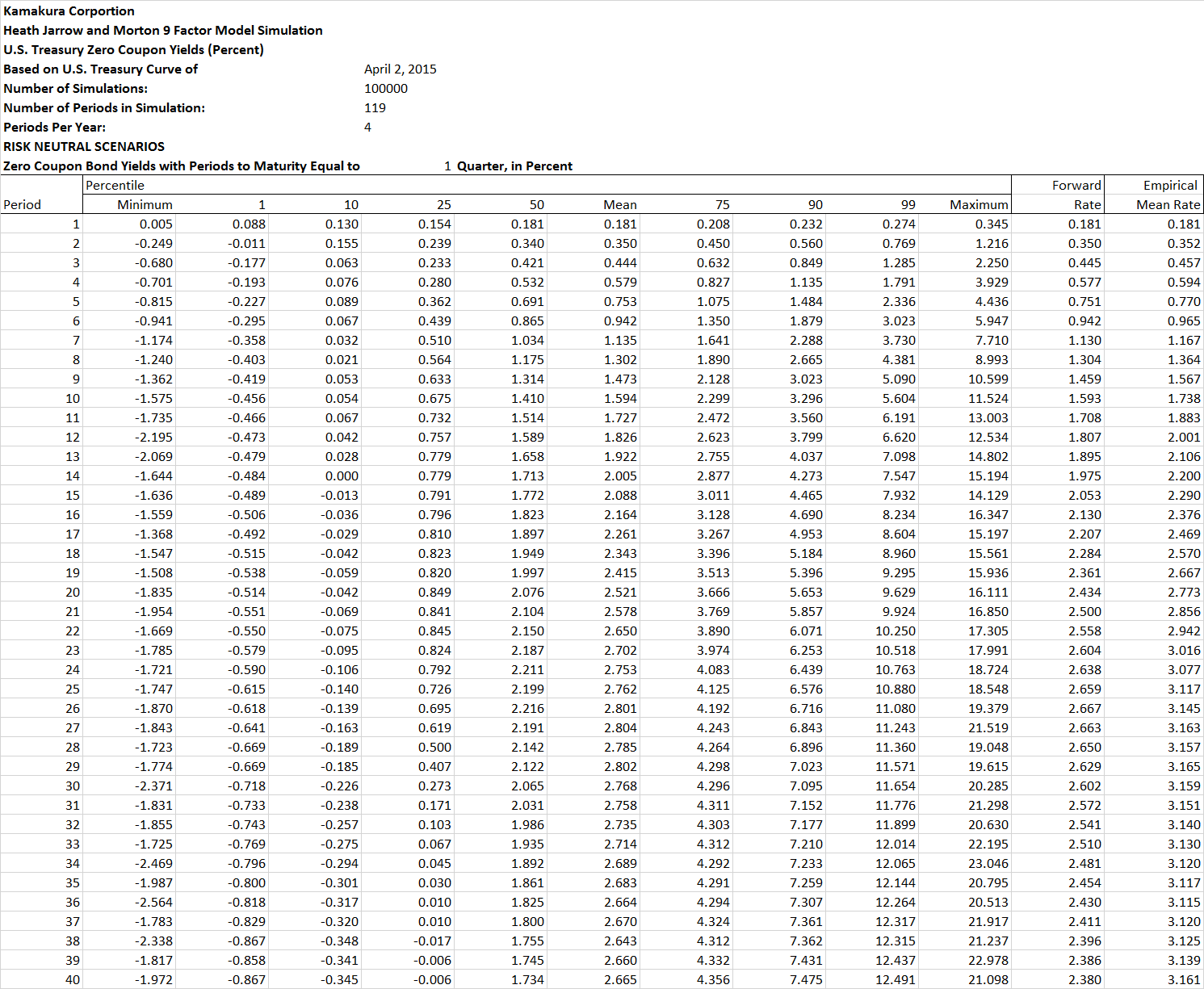

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Treasury Bills - Guide to Understanding How T-Bills Work Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills. ... They come in denominations of $1,000 and offer coupon payments every six months. The 10-year T-note is the most frequently quoted Treasury when assessing the performance of the bond market. It is also used to show the market's take on macroeconomic ...

Us treasury coupon rate

US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC KEY STATS. Yield Open 3.173%. Yield Day High 3.175%. Yield Day Low 3.143%. Yield Prev Close 3.18%. Price 94.4844. Price Change +0.3438. Price Change % +0.3672%. Price Prev Close 94.1406. U.S. Treasury Bond Futures Quotes - CME Group Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. United States Rates & Bonds - Bloomberg 3 Month. 0.00. 2.06. 2.10%. +56. +211. 4:15 AM. GB6:GOV. 6 Month.

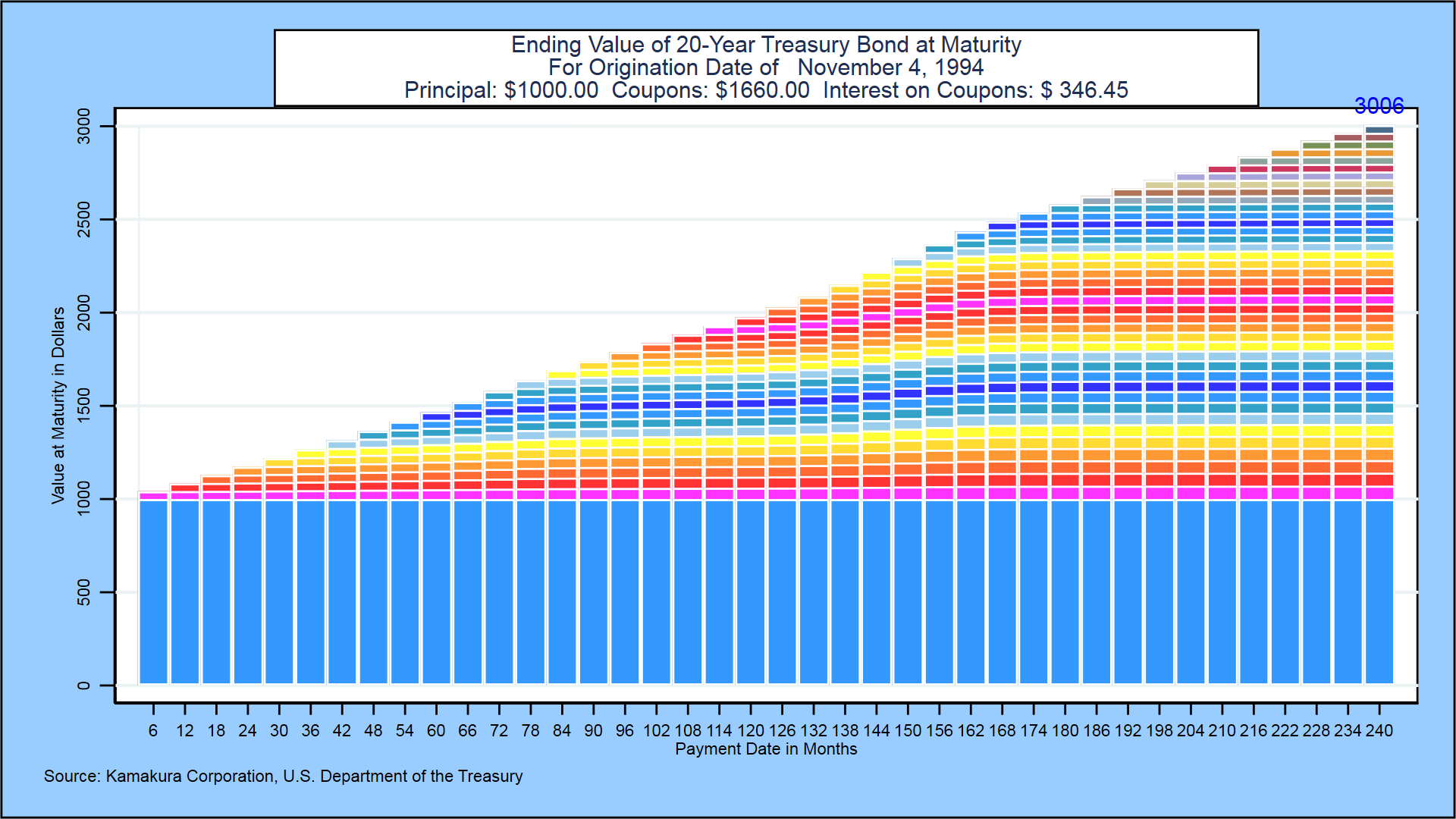

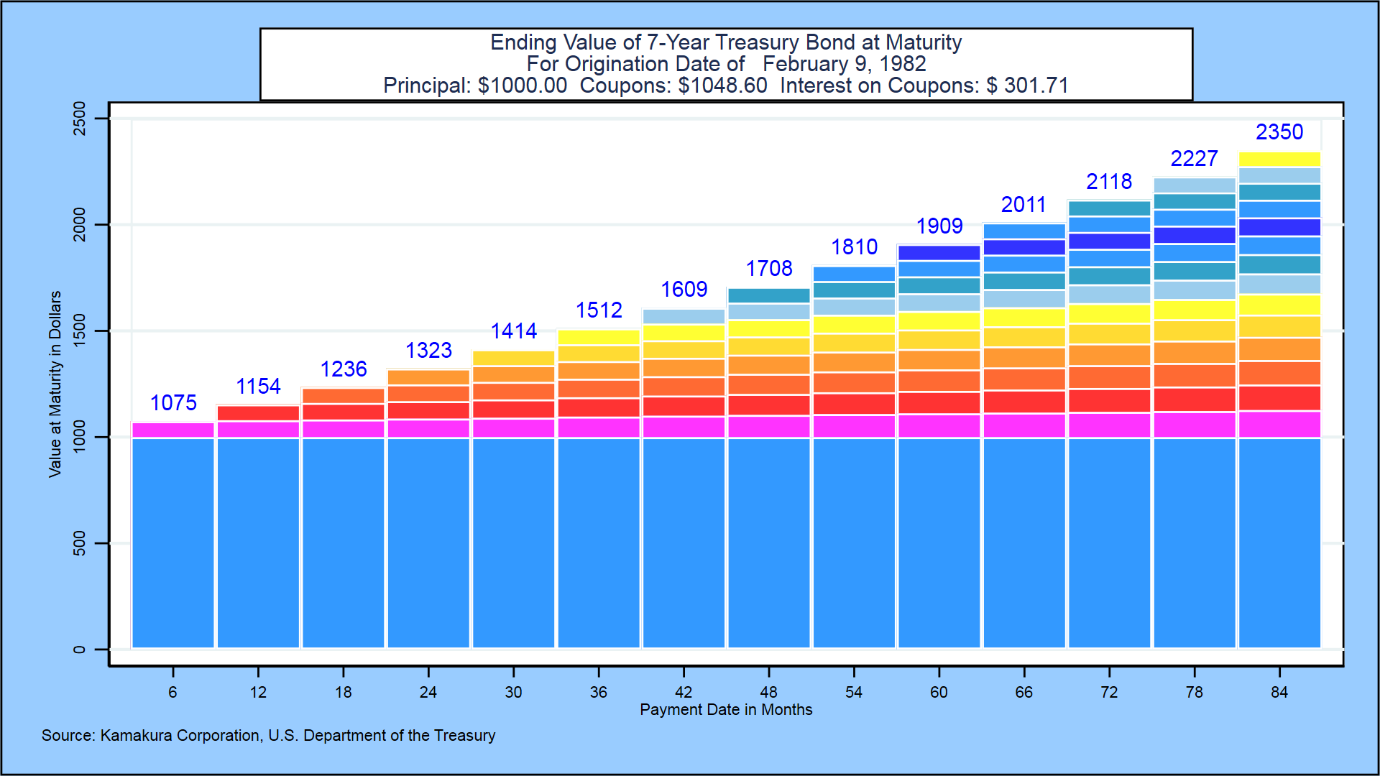

Us treasury coupon rate. Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... 10-Year T-Note Overview - CME Group Futures and Options. Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading ... Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid. US Treasury Bonds - Fidelity US Treasury floating rate notes (FRNs) $1,000: Coupon: 2 years: Interest paid quarterly ...

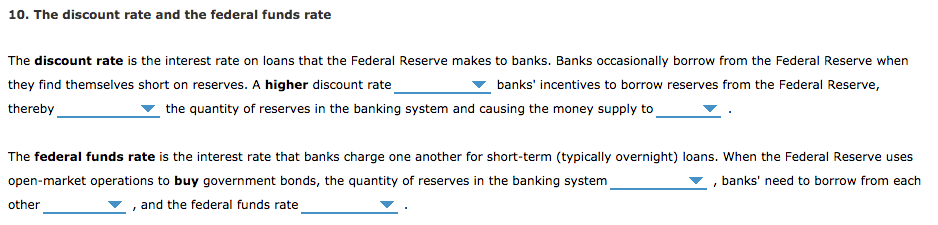

Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. ... The coupon rate can vary depending upon the structure of the ... Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-07-01 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... Kim and Wright (2005) produced this data by fitting a simple three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in ... US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Coupon 2.875% Maturity 2032-05-15 Latest On U.S. 10 Year Treasury Bond yields rise as yield curve inversion sends worrying recession signals 51 Min AgoCNBC.com Traders are betting the Fed could... Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

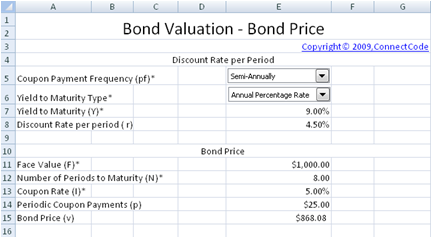

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! United States Rates & Bonds - Bloomberg 3 Month. 0.00. 2.06. 2.10%. +56. +211. 4:15 AM. GB6:GOV. 6 Month. U.S. Treasury Bond Futures Quotes - CME Group Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC KEY STATS. Yield Open 3.173%. Yield Day High 3.175%. Yield Day Low 3.143%. Yield Prev Close 3.18%. Price 94.4844. Price Change +0.3438. Price Change % +0.3672%. Price Prev Close 94.1406.

Post a Comment for "39 us treasury coupon rate"