43 coupon vs interest rate

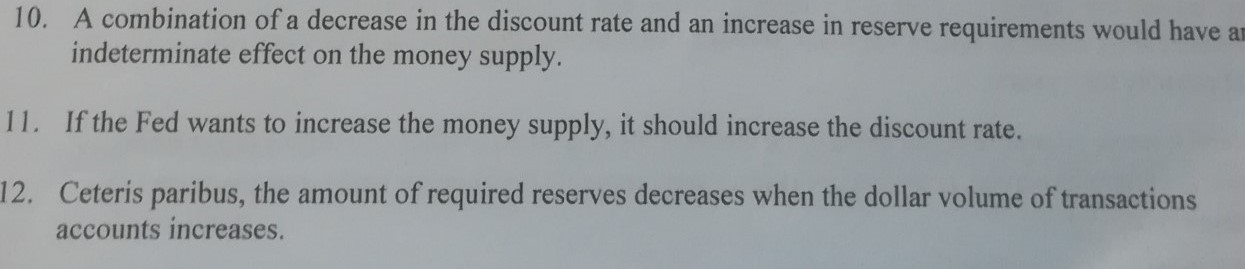

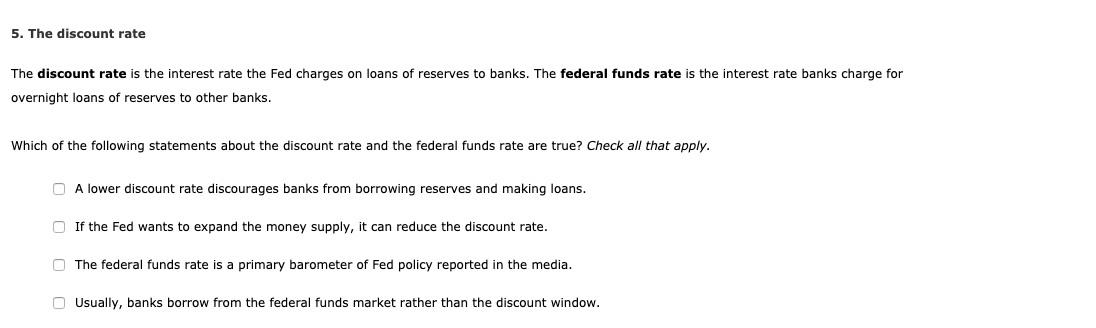

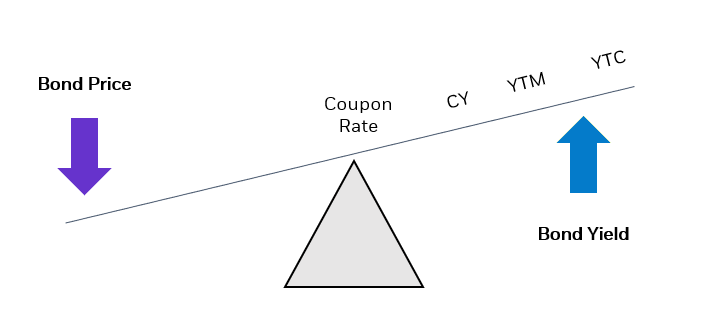

Coupon vs Yield | Top 8 Useful Differences (with Infographics) Let us discuss some of the major Difference Between Coupon vs Yield: The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date. What you should know before opening a new credit card | CNN While credit card interest rates can go as high as 36%, the average credit card charges about 17%, according to Bankrate. ... Many cards will also offer an introductory rate - some as low as 0% ...

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent.

Coupon vs interest rate

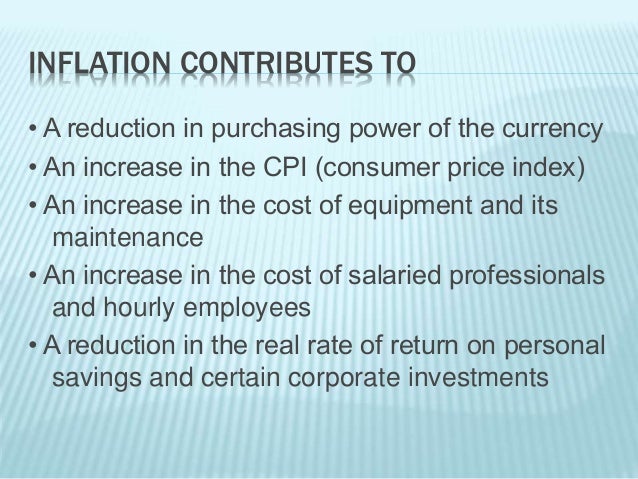

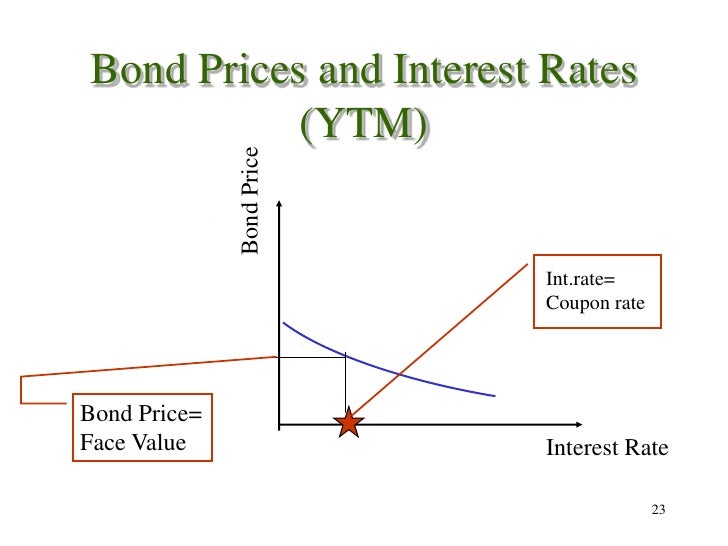

Bond yield vs coupon rate: Why is RBI trying to keep yield down? An increase in YTM indicates below normal coupon rate or that the interest rates are forcibly kept low, resulting in fall in market value of the bonds. Tuesday, Jul 12, 2022. Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ... Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

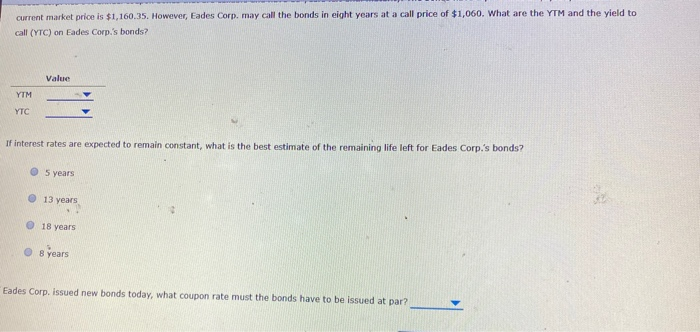

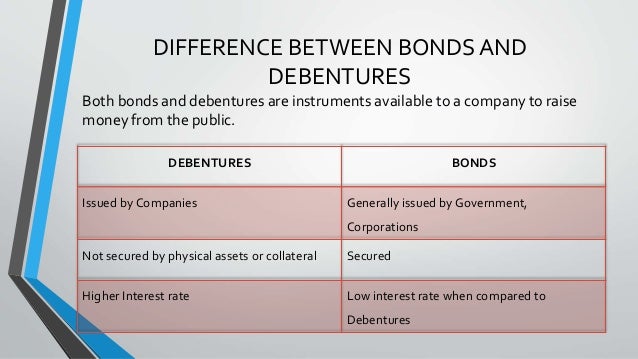

Coupon vs interest rate. Definition of Bond Discount Rate | Pocketsense The bond discount rate is the interest used to price bonds via present valuation calculations. This should not be confused with the bond's stated coupon rate, which is the basis for making coupon payments to the bondholder. The discount rate also is referred to as the bond's yield to maturity, and is the return required to entice an investor to ... Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Coupon Rate Calculator | Bond Coupon For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate will still stay the same. Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond , which is being invested. The interest rate is calculated considering the basis of the riskiness of lending the amount to the borrower. The coupon rate is decided by the issuer of the bonds to the purchaser.

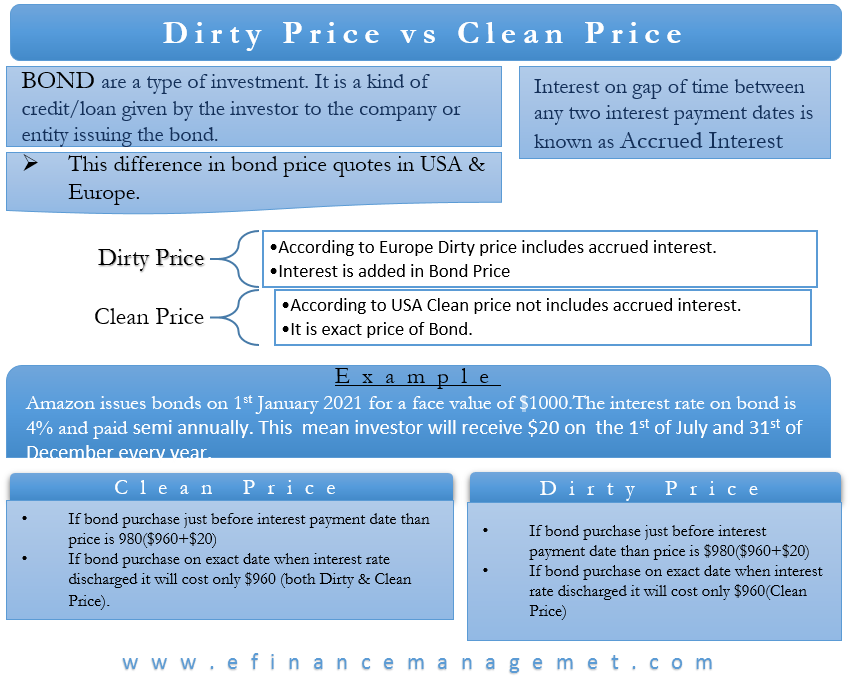

CD Rate and APY: What's the Difference? | Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in... Bond Prices, Rates, and Yields - Fidelity While you own the bond, the prevailing interest rate rises to 7% and then falls to 3%. 1. The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%. Buyers can get around 7% on new bonds, so ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. APY vs Interest Rate: What Is the Difference [Guide for 2022] When calculating the interest rate vs APY, you need to multiply by 100 and get to a percentage to find the interest rate. If you multiply 0.053660387 by 100, you find the interest rate equals 5.366% (if the APY is 5.5 %, and interest is compounded monthly).

APR Vs. Interest Rate: What's The Difference? - Forbes Advisor Going back to Freddie Mac's Primary Mortgage Market survey, there's an important piece of additional information you need to know: The average interest rate of 2.91% comes with an average of 0.8... Difference Between Coupon Rate and Interest Rate In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. The main difference is that the decider of these rates; the coupon rate is decided by the issuer whereas the interest rate is decided by the lender. Individual - TIPS: Rates & Terms - TreasuryDirect TIPS are issued in terms of 5, 10, and 30 years, and are offered in multiples of $100. The price and interest rate of a TIPS are determined at auction. The price may be greater than, less than, or equal to the TIPS' par amount. (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest ... What's the Difference Between Premium Bonds and Discount Bonds? A bond that is trading above its par value (original price) in the secondary market is a premium bond. A bond will trade at a premium when it offers a coupon (interest) rate that is higher than the current prevailing interest rates being offered for new bonds. This is because investors are willing to pay more for the bond's higher yield.

Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Coupon rate refers to the fixed interest payments paid by the bond issuer and will be the same during the life of the bond. On the other hand, market interest rates might rise or fall and impact...

Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

Difference Between Coupon Rate and Required Return The main difference between Coupon Rate and Required Return is that coupon rate is the constant value paid by the bond issuer at regular intervals until the bond matures, whereas required return is the amount accepted by the investor for assuming the responsibility of the stock and as an amount of compensation.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Bond Yield Rate vs. Coupon Rate: What's the Difference? The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or...

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay ...

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements.

What is difference between coupon rate and interest rate? The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Reinvestment Risk (Coupon) vs. Interest Rate Risk (Zero-Coupon) The high "interest rate risk" is reflected in the 10 which tells you (if we temporarily round off the difference between the Mod and Mac duration, maybe the Mod duratoin is 9.5, so ignore the difference): if the rate goes up by 1%, the price of your bond goes down by almost 10%. So we can use duration as a proxy for interest rate risk, hardly ...

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ...

Bond yield vs coupon rate: Why is RBI trying to keep yield down? An increase in YTM indicates below normal coupon rate or that the interest rates are forcibly kept low, resulting in fall in market value of the bonds. Tuesday, Jul 12, 2022.

Post a Comment for "43 coupon vs interest rate"