39 zero coupon bonds formula

Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is ... › bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ...

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Zero coupon bonds formula

Calculating the Yield of a Zero Coupon Bond - YouTube Apr 13, 2015 ... This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to ... Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond ; Formula · PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) ; Model Assumptions. Face Value (FV) = $1,000; Number of Years to ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. · Zero-coupon bonds trade at deep discounts, offering full face value (par) profits ...

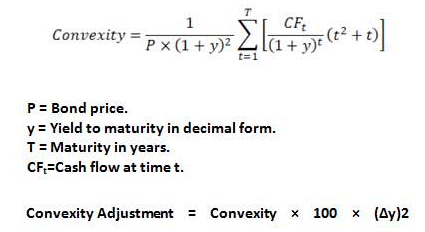

Zero coupon bonds formula. › Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula. A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. Zero Coupon Bond Calculator To calculate a zero coupon bond value, divide the face value by 1 plus the rate raised to the power of the time to maturity. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular ...

Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value ... › zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. › fixed-income-essentials-4689775Fixed Income - Investopedia Dec 05, 2021 · Matilda Bond: A bond denominated in the Australian dollar and issued on the Australian market by a foreign entity that seeks to raise capital from Australian investors. A Matilda Bond may attract ... Zero-Coupon Bond - Definition, How It Works, Formula Pricing Zero-Coupon Bonds · Face value is the future value (maturity value) of the bond; · r is the required rate of return or interest rate; and · n is the number ...

Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. · Zero-coupon bonds trade at deep discounts, offering full face value (par) profits ... Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond ; Formula · PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) ; Model Assumptions. Face Value (FV) = $1,000; Number of Years to ... Calculating the Yield of a Zero Coupon Bond - YouTube Apr 13, 2015 ... This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "39 zero coupon bonds formula"